Car title loans for unemployed individuals offer quick cash but are risky. These short-term secured loans use vehicle titles as collateral, appealing to those with poor credit or unstable income. With strict terms including high interest rates and potential penalties, borrowers must understand the risks of losing their vehicle before taking this route as a temporary financial safety net.

“In times of financial strain, car title loans for unemployed individuals have emerged as a potential lifeline. This article delves into the intricate world of these short-term financing options, specifically tailored to those without traditional employment. We explore the advantages and disadvantages, shedding light on both the immediate relief and long-term implications. By weighing risks against rewards, we aim to provide a comprehensive guide for those considering this non-conventional loan option.”

- Understanding Car Title Loans for Unemployed Individuals

- Potential Benefits and Drawbacks of This Financial Option

- Weighing Risks vs Rewards: A Comprehensive Look

Understanding Car Title Loans for Unemployed Individuals

Car title loans for unemployed individuals have gained popularity as a last-resort option to access quick cash. These loans are designed for people who lack stable employment, offering an alternative means to secure financing when traditional loan applications may be denied due to poor credit history or income instability. In simple terms, it involves using your vehicle’s title as collateral for a short-term loan. The lender retains the title until the debt is repaid, ensuring a security measure for the funds advanced.

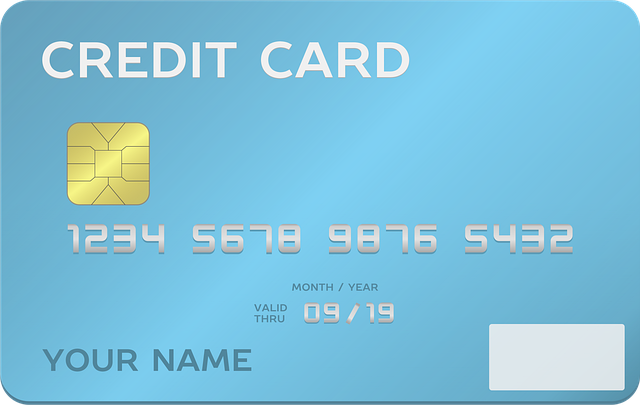

For those in Fort Worth or elsewhere, exploring secured loans like car title loans can be an attractive solution for immediate financial needs. Unlike unsecured personal loans, these loans cater to individuals with bad credit, as the vehicle acts as collateral, minimizing the risk for lenders. However, borrowers should be cautious and understand the terms, including interest rates, repayment periods, and potential penalties for early repayment, to ensure a positive experience with these alternative financing options.

Potential Benefits and Drawbacks of This Financial Option

Car title loans for unemployed individuals can serve as a potential financial lifeline, offering quick access to cash when traditional borrowing avenues are limited. One significant advantage is that these loans provide an alternative source of funds, allowing those without steady employment to bridge immediate financial gaps. Since car title loans are secured by the vehicle’s title, they often come with simpler eligibility requirements compared to conventional loans, making them accessible to a broader range of applicants. This option can be particularly appealing for unemployed folks who still possess their vehicle and want to maintain ownership while seeking financial relief.

However, the drawback is that these loans carry substantial risks. The primary concern revolves around the potential for individuals to lose their vehicles if they fail to repay the loan as agreed. Repayment terms for car title loans can be stringent, demanding regular payments or facing forfeiture of the vehicle’s title. Moreover, high-interest rates and fees associated with such secured loans can quickly escalate outstanding balances, making it challenging for borrowers to regain financial stability. It’s crucial for unemployed individuals considering a title loan to thoroughly understand the title loan process and weigh these drawbacks against their immediate financial needs while keeping their vehicle.

Weighing Risks vs Rewards: A Comprehensive Look

When considering car title loans for unemployed individuals, it’s crucial to weigh the risks against the rewards. On one hand, these loans can provide a rapid source of emergency funds, especially when traditional banking options are limited or non-existent. With just your vehicle equity as collateral, getting approved is generally more accessible for the jobless, and direct deposit of funds can be a lifeline in urgent situations.

However, the risks associated with car title loans cannot be overlooked. The primary concern is the potential loss of your vehicle if you fail to repay the loan on time. This can leave you without transportation, hampering your ability to secure employment or access essential services. Moreover, these loans often come with high-interest rates and stringent repayment terms, which can quickly spiral into a cycle of debt, adding to your financial strain rather than alleviating it.

Car title loans for unemployed individuals offer a temporary financial solution, but it’s crucial to weigh the risks and rewards. While these loans can provide quick cash during desperate times, the potential drawbacks, such as high-interest rates and the risk of repossession, should not be overlooked. Employing alternative financial strategies, like seeking assistance from community resources or building credit through responsible means, may prove to be more sustainable in the long term for those without stable employment.