Car title loans for unemployed individuals offer quick access to funds using vehicle ownership as collateral, but missing payments can lead to repossession and severe financial consequences. Understanding loan conditions and exploring alternative funding options responsibly is crucial to avoid default. Strategies include flexible payment plans, maintaining vehicle care, seeking alternative income sources, and community aid.

“Struggling to secure funding while job hunting? Car title loans for unemployed individuals have gained attention as a quick solution, but understanding their implications is crucial. This article explores the intricacies of car title loans tailored for the unemployed and delves into the consequences of defaulting on these agreements. We’ll guide you through the potential outcomes, offer insights into prevention strategies, and provide options to navigate this challenging situation, ensuring informed decisions.”

- Understanding Car Title Loans for Unemployed Individuals

- Consequences of Defaulting on These Loans

- Options and Strategies to Avoid Default

Understanding Car Title Loans for Unemployed Individuals

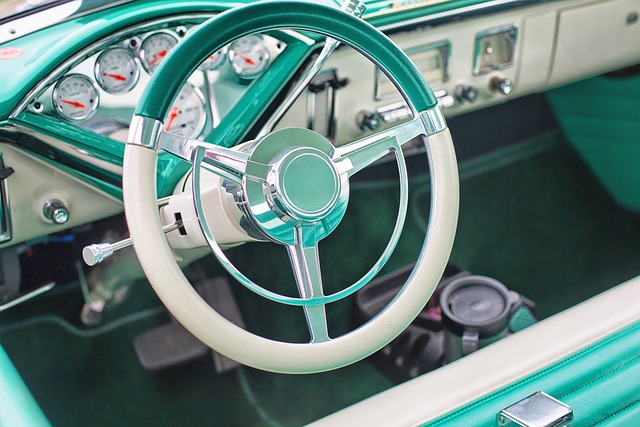

Many unemployed individuals often find themselves facing financial challenges, and Car Title Loans for Unemployed people can offer a potential solution to bridge this gap. These loans are designed specifically to cater to those who may not have a stable income but possess some form of collateral—their vehicle ownership. In simple terms, with a car title loan, you can use your vehicle’s registration as security for the loan amount. This alternative financing method allows you to access funds quickly without strict credit requirements.

Fort Worth Loans, known for their accessibility, provide an opportunity for people to maintain their vehicle ownership while seeking financial relief. Unlike traditional loans that might require extensive documentation and a good credit score, car title loans focus on the value of your vehicle. This makes it feasible for individuals in various situations, including those facing unemployment, to secure funding. The process is generally straightforward: you hand over your vehicle’s registration, and if approved, you’ll receive a loan amount based on your vehicle’s assessed value, ensuring that you can keep your vehicle while managing your financial obligations during challenging times.

Consequences of Defaulting on These Loans

When an individual who has taken out a car title loan for unemployment finds themselves unable to make payments as agreed, the consequences can be severe. These loans, often marketed as quick funding solutions for those with limited employment options or bad credit, come with high-interest rates and strict terms. Defaulting means failing to meet these financial obligations, leading to several negative impacts. Lenders have the right to repossess the secured asset, in this case, your vehicle, if payments aren’t kept up. This can leave individuals without transportation, a critical issue for those relying on their car for daily commutes or income-generating activities.

Repossession isn’t the only outcome; defaulting also damages credit scores further, making it even harder to secure future loans or favorable financial terms. Lenders may charge additional fees and penalties, adding to the financial burden. For unemployed individuals already facing economic challenges, these repercussions can be devastating, potentially pushing them deeper into debt or requiring them to take more desperate measures to cover living expenses. It’s a challenging cycle that highlights the importance of understanding loan conditions and exploring alternative funding options, such as no-credit-check or bad-credit loans, responsibly to avoid such dire consequences.

Options and Strategies to Avoid Default

If you’re unemployed and considering a car title loan, it’s crucial to understand the potential consequences of defaulting on such a loan. However, before that hits, explore options designed to help borrowers maintain vehicle ownership during challenging times. One strategy is to communicate openly with your lender; many are willing to work out payment plans or extend terms if you explain your situation. Additionally, keeping up with insurance and regular maintenance can demonstrate responsible vehicle equity management, making it more likely for lenders to offer favorable terms or adjustments.

Another approach involves exploring alternative income sources or seeking assistance from community resources. Even temporary employment or government aid programs could help in meeting loan obligations. Remember, defaulting on a car title loan means giving up your vehicle, so it’s in your best interest to exhaust all efforts to keep it, leveraging both personal initiatives and available support systems while managing your existing debt responsibilities.

Car title loans for unemployed individuals can be a challenging option due to their high-risk nature, but understanding the consequences of defaulting is essential. If unable to repay, borrowers face severe repercussions, including repossession of their vehicle and damaged credit scores. However, proactive strategies exist to avoid default. Exploring alternative income sources, negotiating extension terms with lenders, or seeking financial assistance from community resources can help unemployed individuals navigate these loans successfully and maintain control over their assets.